Rolling your negative equity into a lease

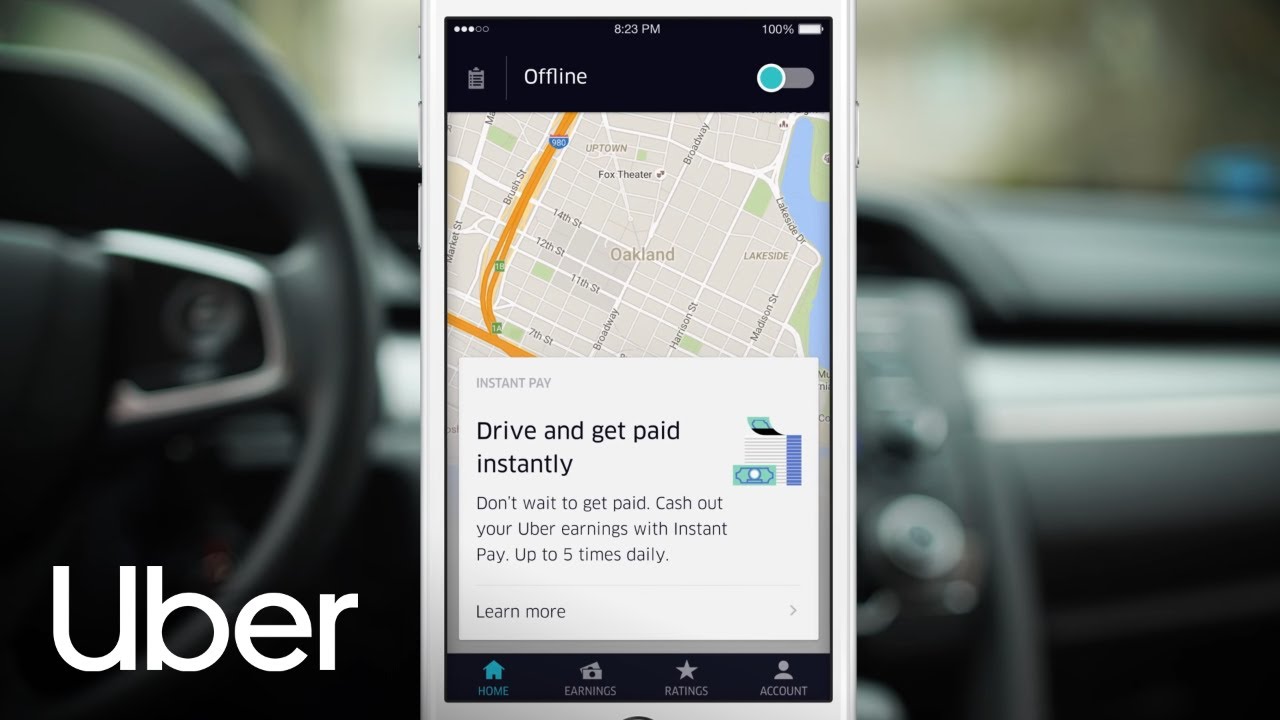

When you trade your vehicle into a dealer and pay off the remaining balance, you’re off the hook financially. But you’re also left without a car. Although public transit and ridesharing are common alternatives, you might still want your own ride.

In that case, it’s not uncommon for people to trade in for a used car. You can roll your negative equity into a smaller loan with, ideally, a lower monthly payment. In turn, you’ll have more money to apply to your outstanding balance.

However, this approach is not a recommended solution because your new loan is immediately upside-down. You aren’t erasing the negative equity.

Keep in mind, by rolling your loan into a cheaper car, you’re also extending your loan’s term. The longer your loan term, the more time your next car has to depreciate while you still owe money. If you don’t proactively repay your new car loan ahead of schedule, you could dig yourself into a worse financial hole.

You also have the option of rolling your negative equity into a lease – rather than another loan. In case you’re unfamiliar, leasing a vehicle is akin to renting instead of owning a house. You don’t own a leased vehicle, you’re borrowing it for a set period of time. Leases remove the burden of resale once the lease matures.

Compared to rolling a loan into a new vehicle, the prie: lower monthly loan payments. However, you’re still responsible for the negative equity, which would be accounted for in the cost of the new lease.

Trading in with dealer incentives

Although it’s becoming less common, borrowers can also try to find vehicles with dealer incentives to reduce their negative equity. Sometimes, dealerships promote their inventory by offering significant discounts off sticker prices or cash rebates for a limited time. Dealerships are more likely to employ this tactic toward the end of the year before the next lineup of models launches. Continua a leggere