Borrowers might possibly offer the expression of its household financing if they’re worried about purchasing it well. Photograph: AntonioGuillem/Getty Images/iStockphoto

Individuals might possibly extend the word of their household mortgage if they are concerned about expenses it off. Photograph: AntonioGuillem/Getty Photographs/iStockphoto

I t is the home loan which was branded good ticking timebomb. The town regulator recently warned towards significant number of individuals that have focus-simply mortgage loans who are at risk for losing their houses as the they are incapable of pay off whatever they are obligated to pay on stop of one’s loan identity.

Following latest security bell regarding Financial Run Power (FCA), consumer communities are in fact attempting to assist people who have desire-simply mortgages – a number of which try avoiding talking to the home loan seller – to answer the problem.

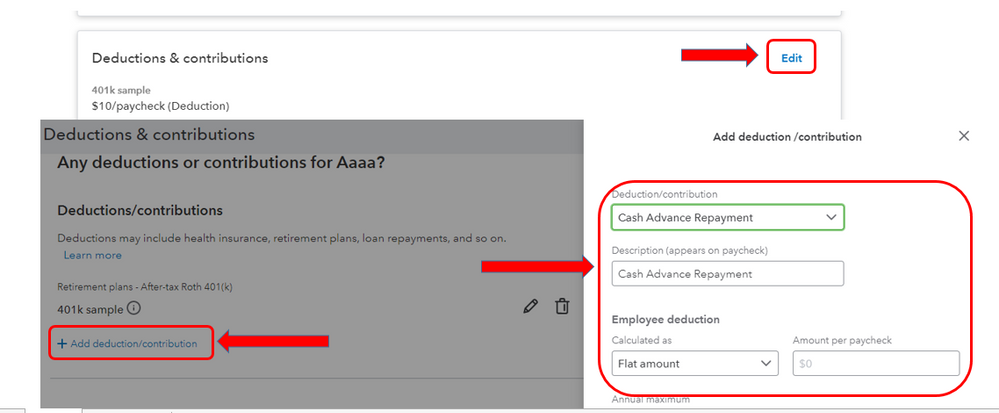

The advantage of a destination-only financial is the fact that monthly premiums would be somewhat straight down than just an installment financial, says David Blake at which? Mortgage Advisers. But not, interest-simply mortgages are lesser known than simply they had previously been. Despite the http://www.simplycashadvance.net/loans/payday-loan-consolidation/ advantages, they’re able to lead to economic uncertainty towards the end of the label.

The issue

That have notice-simply mortgages, brand new borrower produces zero capital money with the financing, merely focus. He or she is anticipated to enjoys an investment package in position so you’re able to pay-off the debt but some ones agreements was indeed underperforming, though some consumers never ever even-set him or her upwards.

Most procedures will in all probability was basically ended up selling with mortgage endowments, so there need come a means of paying down the loan, even when it was underperforming, states parece from problems web site Resolver.

Although not, the newest FCA’s nervousness is inspired by the point that some individuals took endowment compensation and you may didn’t understand they must pay back the loan inside. There are also the people which realized that they had interest-simply procedures but was in fact counting on an inheritance and other windfalls to pay for finally costs. This is not as rare since you might imagine, because the new heyday of interest-simply procedures have been from the in love financing days before the monetary failure.

Sooner rather than later

Approximately 600,100 interest-simply mortgages are caused by expire of the 2020. The FCA says there are 2 maturity peaks asked next into the 2027-twenty-eight and you will 2032. Because schedules may seem like they are specific range when you look at the the long run, people have come informed to act eventually. The FCA has granted direction for these towards the mortgages, claiming the sooner it correspond with its bank, the better.

And this? says the first step would be to opinion their arrangements and you will see whether it is possible to pay extent within the complete. If you have an enthusiastic endowment plan in place, it’s always best to view just how much was available whenever the insurance policy ends.

According to the FCA, acting before you may suggest individuals is very likely to become in a position to either change to a payment home loan, part-capital installment mortgage, continue the phrase or build a lot more payments. Afterwards this type of possibilities could possibly get disappear together with potential for attempting to sell the home can become more likely.

Remortgaging

If you’re unable to pay back the loan entirely, you might have to check out remortgaging your home, states Blake. If you stay with the same lender, they can often option that a cost home loan or expand the expression of one’s current plan – if you may proceed to increased interest.

Those with appeal-simply mortgage loans from just before may have issues switching because the since then, lenders had to put borrowers’ fees arrangements under higher scrutiny that have an entire value assessment.

When giving brand new funds, lenders must assess if or not you can afford to help make the called for costs, states pointers about government’s Money Pointers Provider. This can include instances when you want to remortgage to some other lender your financial will have to fulfill in itself as you are able to afford the financing.

Your current lender is actually allowed to offer you a new price (internet explorer change to another rate of interest) as long as it generally does not involve improving the count you use (besides any charges for changing).

The brand new FCA features depicted the results into the average financial if the the loan words was basically altered. In the case of an excellent ?125,000 attract-simply mortgage removed more 25 years at a rate from 3%, this new repayments was ?313 30 days, with ?125,000 owed at the conclusion of the word. The total cost will be ?218,750.

When someone chooses to change to a payment contract after ten years, the latest monthly costs rise in order to ?864 30 days during the last fifteen years, that have total cost ?192,881.

Regarding a debtor changing that have 10 years kept, its monthly payment could be ?1,208 monthly plus the final rates is actually ?201,092.

Lenders’ obligation

In many cases people don’t realise they’ve maybe not been paying off the administrative centre. Appear to this will be people whose people have ended and additionally they may well not know what type of financial is to their assets.

Terrible of the many could be the people who failed to realise it just weren’t settling the investment. I have spoken to a few historically, states James. I am sorry to say you to in most cases, he’s people whose partners are gone and you may who next provides discovered their residence is not getting paid.

This kind of points, mortgage team is always to reasonably have been likely to features flagged up the issues about how the possessions were to be distributed to possess, so if they haven’t done so they want to assembled a payment policy for the house or property, considering the client’s profit. Although not, it is not a legal duty, therefore a person in which condition would be turfed out by the loan vendor.

Lascia un Commento

Vuoi partecipare alla discussione?Sentitevi liberi di contribuire!