Interest rates and mortgage restrictions for the USAA unsecured loans is subject adjust anytime and you will rely on the new borrower’s borrowing history and you will financial situation. Due to the fact a broad book, check out information at this writing:

- Minimal amount borrowed: $2,five hundred

- Restriction amount borrowed: $100,100000

- Rate of interest range: 6.49% so you’re able to %

- Payment identity duration: a dozen so you’re able to 84 weeks

- thirty-six times restriction to have money below $5,100

- 48 week limit to have money lower than $10,100000

- 60 day limit getting finance below $15,100

- 72 day restrict to possess fund lower than $20,one hundred thousand

- Offers designed for automatic loan fees

USAA cash-away refinancing

USAA now offers dollars-out refinancing, but it will most likely not sound right for those who should obtain reduced mortgage quantity. That’s because brand new Virtual assistant adds an excellent 3.6% investment fee towards refinance loan equilibrium, and that fee applies to the whole amount borrowed, not only the money-out. It will be a good option if you need a lot of cash as Va lets bucks-out refinancing doing a hundred% (even when loan providers will draw the fresh line during the 90%).

Since the USAA doesn’t provide HELOCs, the unsecured loans otherwise dollars-out refinancing is an excellent options to opening a type of borrowing from the https://www.speedycashloan.net/loans/online-personal-loans-with-co-signer bank.

The advantage of HELOCs is the freedom that individuals can be faucet the credit range and you may pay desire just on which they use. Although not, personal loans and cash-out refinancing send lump amounts within closure. Consumers immediately initiate paying rates of interest into whole mortgage equilibrium.

Cash-away refinancing can get work for borrowers that have apparently small home loan stability who need a ton of money. Homeowners is always to evaluate the cost of an earnings-away refinance with this regarding an elementary re-finance alongside an excellent HELOC otherwise consumer loan.

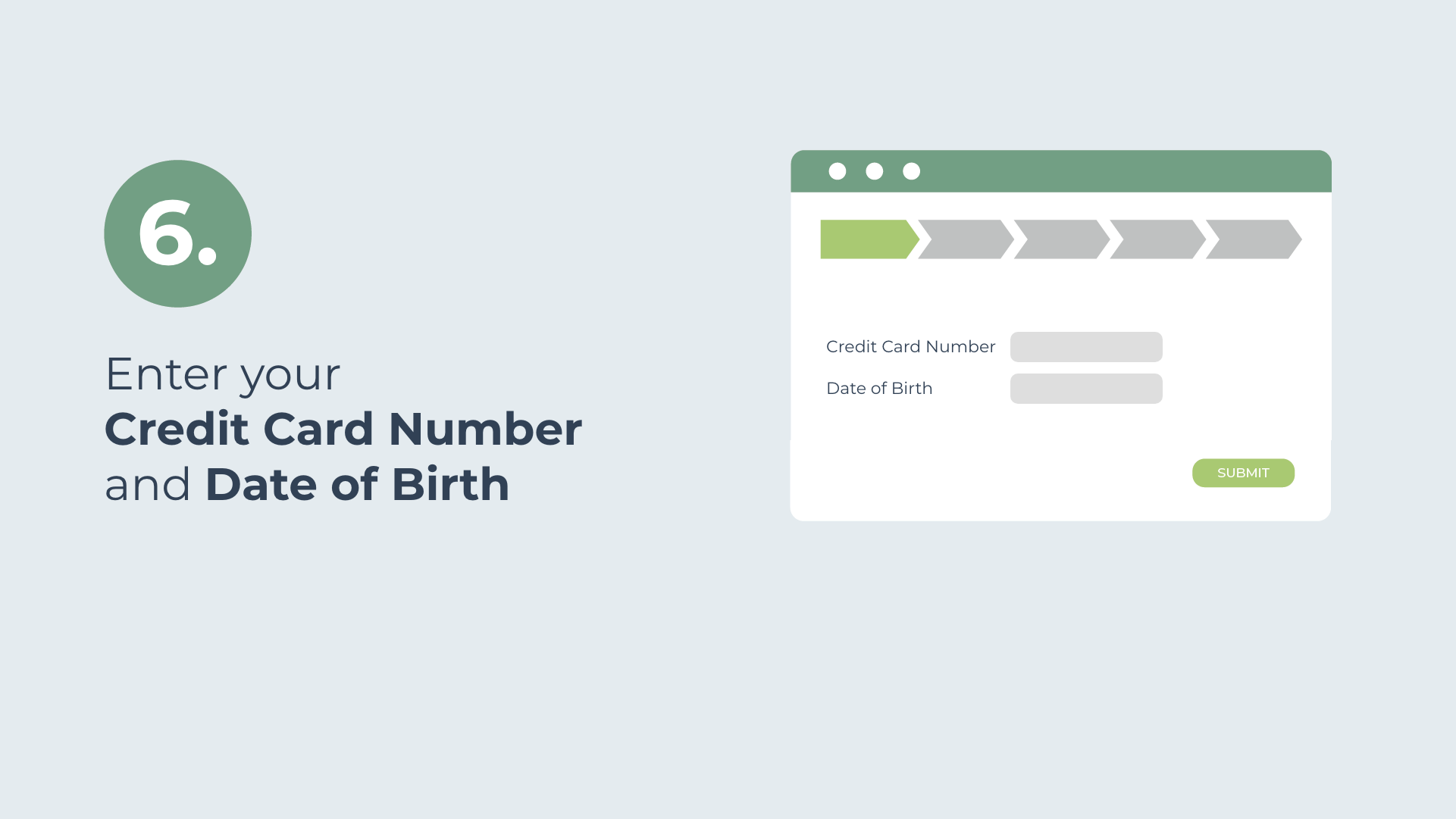

Ideas on how to Submit an application for USAA Family Equity Money

As noted a lot more than, because the USAA does not offer family collateral money, an unsecured loan or dollars-away re-finance could be a practical substitute for certain consumers.

In case the software program is recognized, USAA will show brand new borrower an interest rate promote immediately. In case the applicant decides to go ahead toward mortgage, money may be readily available the moment 24 hours just after recognition.

Overall, loan individuals can get to include their money and you can a career background. They are going to record its financial obligations for example rent, almost every other financing costs, etcetera. This will be to aid the lending company determine whether individuals are able to settle this new mortgage.

Property owners sign up for an earnings-aside re-finance because they perform having one financial unit and you can incur closing costs, assessment fees, and you can lender costs in addition to the Virtual assistant financing fee.

USAA often pull a credit file just before approving financing. Before you apply, people is check that report on their own to find out if mistakes you want as remedied or if perhaps they need to enhance their credit history before applying. A far greater credit rating develops an applicant’s odds of approval and you can may also gather a much better interest rate.

Note that whenever a loan provider pulls a credit report, it will make a difficult inquiry. Unnecessary tough concerns in this a short span can be harm a man or woman’s credit score. So, it’s a good idea to accomplish certain looking around and you will narrow down brand new world of potential loan providers prior to starting so you can fill in applications.

USAA Expert and User Reviews

The fresh 2021 JD Electricity You.S. Individual Credit Fulfillment Study gave USAA a high get private financing than nearly any of the seven almost every other providers ranked.

In addition, Expenses amassed research off ten various other pro and you will individual weblogs and averaged the brand new product reviews to have USAA to your the web sites. User evaluations to have USAA was limited to the five of your own ten sites. In which possible, studies out-of USAA’s signature loans were used; in the event that those just weren’t available, ratings getting USAA total were used.

Lascia un Commento

Vuoi partecipare alla discussione?Sentitevi liberi di contribuire!